In forming this rank, the analyst opinions from the major brokerage houses were tallied, and averaged; then, the underlying components of the Metals Channel Global Mining Titans Index were ranked according to those averages. Investors often interpret analyst opinions from different angles — a popular analyst pick could mean that many sharp minds individually came to the same bullish conclusion, and therefore the stock should do well, but it could also mean that if the company stumbles, that would come as a negative surprise.

From the other direction, when companies have a low rank among analysts, it isn’t necessarily the case that investors should conclude that the stock will perform poorly. It can, of course, but a bullish investor could also take the contrarian angle and read into the data that there is lots of room for upside because the stock is so out of favor.

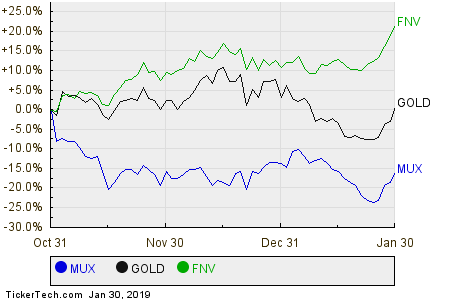

MUX operates in the Precious Metals sector, among companies like Barrick Gold Corp. (GOLD) which is off about 1.1% today, and Franco-Nevada Corp (FNV) trading lower by about 1.3%. Below is a three month price history chart comparing the stock performance of MUX, versus GOLD and FNV.

Special Offer: Receive our best dividend ideas directly to your inbox each afternoon with the Dividend Channel Premium Newsletter

MUX is currently trading down about 1.7% midday Wednesday.